Topical Journals and Resources

- Energy Policy

- EconPapers

- QED Working Papers

- Canadian Journal of Economics

- International Journal of Energy, Environment and Economics

- Energy Economics

Journal of Energy Finance & Development, Copyright © 2009 Elsevier Inc. All rights reserved, Publication History: Incorporated into Energy Economics

Journals Ranked by Impact[1]

Literature Reviews[edit | edit source]

Searches[edit | edit source]

- "government investment" in factory

- government benefit cost analysis

- government revenue

- government investment programs

- subsidy in Canada industry

Government Revenue[edit | edit source]

Ontario - Provincial corporation tax[edit | edit source]

The Ontario basic income tax rate is 14%.Calculated using this worksheet.

Corporate minimum tax, paid if assets exceed $5,000,000 or total revenue exceeds $10,000,000 [2], calculated using worksheet.

The Ontario small business deduction reduces Ontario basic income tax by 8.5%.

Capital tax: different depending on when you file the tax[3], either 0.15% before 2010, or 0.225% after 2010. A note on capital taxes for manufacturers is: "A manufacturing corporation whose Ontario manufacturing labour cost is more than 20% of its total Ontario labour cost for the year can claim a capital tax credit for manufacturers. If the corporation's manufacturing labour cost is at least 50% of its total Ontario labour cost for the year, this credit will equal the amount of capital tax otherwise payable. Calculate the tax credit in Part 4 of Schedule 515, Ontario Capital Tax on Other Than Financial Institutions."

Ontario additional tax re: Crown royalties[4]

There are a number of credits that could be received which are all found on the main site [5].

Federal Corporate tax rates[edit | edit source]

Info can be found here [6].

The basic rate is 38%, 28% after federal tax abatement (although there are reductions if you are a small business). The rate in Ontario is 14% for the higher tax bracket.

In general, while individual file their taxes yearly, manufacturing plants have to file the revenues and expenses monthly [7]. You can calculate what a company would pay [8] by adding the Tax on Income, Tax on corporations paying dividends on taxable preferred shares and Additional tax on authorized foreign banks.

A manufacturing plant would pay property tax which is based of size and location of the plant. The 'better' the location, the higher property tax.

GST is paid to the government on all insurance claims.

OECD Tax Database[edit | edit source]

- Table I.1.Marginal personal income tax and social security contribution rates on gross labour income (Excel file)

- Table I.2.Average personal income tax and social security contribution rates on gross labour income (Excel file)

- Table I.3.'All-in' average personal income tax rates at APW by family type (Excel file)

- Table I.4.Top marginal personal income tax rates for employee (Excel file)

- Table I.5.Central government personal income tax rates and thresholds (Excel file)

- Table I.6.Sub-central personal income tax rates (general) (Excel file)

- Table I.7.Sub-central personal income tax rates (tax on income at progressive rates) (Excel file)

- Table II.1Corporate income tax rate (Excel file)

- Table II.2Targeted corporate income tax rates (Excel file)

- Table II.3Sub-central corporate income tax rates (Excel file)

- Table II.4Overall statutory tax rates on dividend income (Excel file)

- Table III.1Employee social security contribution rates

- Table III.2Employer social security contribution rates

- Table III.3Self-employed social security contribution rates

- Table IV.1 VAT/GST rates

Government Investment[edit | edit source]

The Cost of Air Pollution and Green House Gases

Ontario Medical Association, ICAP 2005 Report Illness Costs of Air Pollution, June 2005, ISBN 0-919047-54-8[1]

This paper covers the health costs and damage estimates due to air pollution in Ontario in 2005 as predicted by the Ontario Medical Association (OMA). The paper estimates the projections in air pollution related illnesses and the associated costs from 2005 to 2026. The results are based on an "Illness Costs of Air Pollution" (ICAP) software model and findings on health effects and economic costs of air pollution in Ontario. The model has been updated in 2005, with an increased scientific understanding of smog's health effects. Included in the new OMA determinations of smog's toll are new health studies on the chronic effects of exposure, new air pollution and demographic data and extensive analysis of the principle studies on the health effects of air pollution.

Even though there are improvements in the model, it is still noted that there are still gaps in scientific understanding and thus further improvements to ICAP will be possible in the future. Of most concern to the OMA is the lack of credible studies on doctors' office visits due to smog related illness. OMA has not included a value for this important and expensive impact, thus still underestimating smog's overall cost.

ICAP provides estimates of health effects according to four major health endpoints: Premature Death,Hospital Admissions, Emergency Room Visits and Minor Illnesses. Damages for each of these major health endpoints may be further broken down by more specific illness categories, age groups and geographic locations. The smog effects were estimated knowing the current data on air pollution due to ozone (O3), Particulate Matter 2.5 microns (PM2.5), carbon monoxide (CO), Sulphur Dioxide (SO2), and Nitrogen Dioxide (NO2). The projections were made assuming air quality does not improve.

DSS Management Consultants Inc. and RWDI Air Inc., Cost Benefit Analysis: Replacing Ontario's Coal-Fired Electricity Generation , Prepared for the Ontario Ministry of Energy, April 2005

This report covers the methodology, data and results of an independent cost-benefit analysis (CBA) of the financial costs and health and environmental damages associated with four electricity generation scenarios. The aim of the report was to identify the prospects for replacing all of Ontario's coal-fired generating facilities. The different scenarios include the use of coal-fired (base case), gas and/or nuclear electricity generation. Air quality modelling was used to project the emission profiles of each scenario and the monetary impact of each was estimated. The total cost of generation of electricity included the financial costs as well as the health and environmental damages. The health and environmental damages associated with coal was $127/MWh (77% of total cost), with gas-replacement was $20/MWh, with Nuclear/Gas mixture was $15/MWh and finally was $53.55/MWh when using stringent controls on coal fired plants.

The health impacts considered the effect of air quality on premature deaths, hospital admissions, emergency room visits minor illness cases by implementing each scenario. Environmental damages include economic damage estimates relating to the soiling of household materials, crop loss and greenhouse gas emissions.The estimates of economic damages for environmental effects are dominated by the costs of greenhouse gas control and carbon sequestration (or permit purchasing depending on which is less expensive). For example, with Scenario 1 (Base Case Coal-fired), greenhouse gas costs comprise 94% of the total estimated environmental damages. The study is limited to risks associated with ground-level ozone (O3)and particulate matter (primarily PM 2.5 microns. In addition, economic damages associated with greenhouse gas (GHG) emissions were estimated.The authors mention the limitation is being able to accurately estimate the health and environmental damages, and indicate room for further research.

Clean Air Online, Sources of Pollutions, Electricity Generation, Canada

The electricity sector is unique among industrial sectors in its very large contribution to emissions associated with nearly all air issues. Electricity generation produces a large share of Canadian nitrogen oxides and sulphur dioxide emissions, which contribute to smog and acid rain and the formation of fine particulate matter. It is the largest uncontrolled industrial source of mercury emissions in Canada. Fossil fuel-fired electric power plants also emit carbon dioxide, which contributes to climate change. In addition, the sector has significant impacts on water and habitat and species. In particular, hydro dams and transmission lines have significant effects on water and biodiversity.

Includes stats on each pollutant and its source.

Carbon emissions from burning coal are one of the leading causes of global warming. Acid rain, from sulfur emissions, is almost entirely due to coal burning. From mining to processing to transportation to burning to disposal, coal has more environmental impacts than any other energy source. While some of these can be lessened with effort, others, like carbon emissions, are an inevitable product of coal use. Its time to send our dirty old King into retirement.

Government Programs for Businesses

This section outlines the available programs for renewable energy development in Ontario, Canada. The focus here will be potential for PV investment, although other energy technologies have specific programs.

- Eligible Recipient: An eligible recipient is a business, institution or organization (e.g. an independent power producer, a provincial Crown corporation, an electrical utility or energy co-operative) that owns a qualifying project to produce electricity for sale in Canada, for use by its co-op members or for its own consumption.

- Qualifying Projects: A qualifying project is defined as a new or refurbished low-impact renewable-generating facility, or the clearly delineated expansion of an existing low-impact renewable-generating facility that is located in Canada.The qualifying project must be of a total rated capacity of 1 megawatt (MW) or greater, with the exception of wind energy projects that were commissioned after March 31, 2006, and before April 1, 2007, which must have a total capacity of at least 500 kilowatts (kW).

- Funding: ecoENERGY for Renewable Power will provide an incentive of one cent per kilowatt-hour for up to 10 years to eligible low-impact, renewable electricity projects constructed between April 1, 2007 and March 31, 2011.

- The maximum contribution payable per qualifying project will be $80 million over 10 years.

- The maximum contribution to an eligible recipient over the life of the ecoENERGY RP will be $256 million.

- Technology Development Fund - Ontario Power AuthorityTDF

- Description: Financial assistance to support pre-commercial technologies or applications that have the potential to improve electricity supply, conservation or demand management.

- Terms/Assistance/Benefits: Maximum contribution by the OPA for any one project is $250,000.

- Next Generation of Jobs Fund - Jobs & Investment Program NGJF

- Description: A five-year $1.15 billion strategy to support companies in business expansion /retention and attract foreign investment in green auto research, parts production and assembly; clean fuels research, development and commercialization; manufacturing, processing, environmental technologies; services (ICT & Financial), anchor investments to support cluster development; and opportunity based/ unique investments.

- Terms/Assistance/Benefits: The fund will provide up to 15% of the total eligible costs of an approved project. Eligible projects must meet thresholds of $25 million in investment or create /retain 100 jobs within five years.

Electricity Generation in Canada

Stats for demand, supply and capacity in Canada, including by province.

Canadian Environmental Protection Act

Available from the Government of Canada website here, [9]

PV Thin Film Solar Manufacturing Plant[edit | edit source]

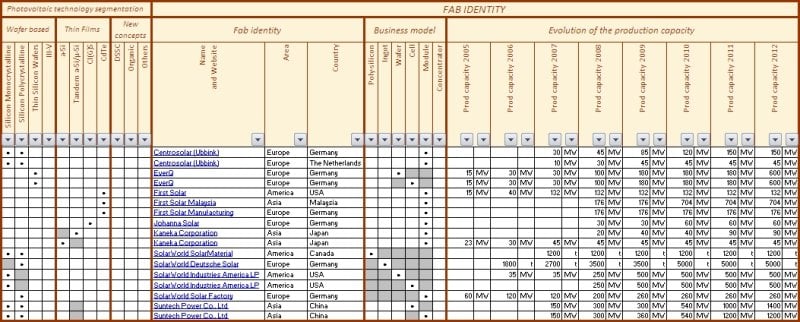

Various PV thin film manufacturing plants exist in the world today and the number being produced is growing.

M+W Zander completes factory to manufacture solar cells for Q-Cells in Malaysia 500 megawatt annual output, June 16, 2009]

Engineering company M+W Zander has designed and built a new solar cell manufacturing facility for Q-Cells, Malaysia, and has handed over the facility on schedule. This major project was completed within a tight construction time frame of less than 8 months to achieve Ready for Equipment. The three-storey solar-cell factory with eight production lines has an annual output of 500 megawatts (peak).

[10]

Solar Generation - V - 2008

Solar electricity for over one billion people and two million jobs by 2020

This report by the EPIA (European Photovoltaic Industry Association) and Green Peace captures the global status of the Solar Photovoltaic Industry in 2008.[3] Solar Generation - V - 2008The report outlines the key political actions required and PV's contribution to Industry, Employment, Global Electricity Supply and the Environment projected to 2030.

Some assumptions made include:

- Carbon dioxide savings estimated to be an average of 0.6 kg of CO2 per kilowatt hour of output from a solar generator

- Two scenarios used for the analysis in terms of worldwide growth of the Solar industry:

- Advanced Scenario based on additional support mechanisms that lead to dynamic worldwide growth (growth rate 40%(2010)reduced to 15% (2030)

- Moderate Scenario based on lower level of political commitment (growth rate 30% (2010)reduced to 10% (2030))

It is estimated that PV provides the following job creation:

- Production: 10 jobs per MW

- Installation: 33 jobs per MW (installers, retailers, engineers)

- Wholesaling/ Indirect Supply: 3-4 jobs per MW

- Research: 1-2 jobs per MW

In 2007, the German PV industry alone employed 42,000 people. In Germany, there are in fact currently more jobs in the PV sector than in the nuclear industry. The PV industry therefore has the potential to create vast amounts of employment.

PV Status Report 2008

Research, Solar Cell Production and Market Implementation of Photovoltaics[4] PV Report 2008

J. M. Pearce,Industrial Symbiosis for Very Large Scale Photovoltaic Manufacturing, Renewable Energy 33, pp. 1101-1108, 2008

ISSN 0960-1481, DOI: 10.1016/j.renene.2007.07.002. (http://www.sciencedirect.com/science/article/B6V4S-4PJ6BJ9-1/2/f3df89a481dc23c1853d998d0d282cae)

The world's governments must take significant commitments in policy and investment directives in renewable technologies to drastically reduce greenhouse gas (GHG) emissions. Solar Photovoltaic (PV) cells are technically feasible renewable energy generators that provide a means to reducing GHGs and meeting our energy needs. "This paper explores utilizing industrial symbiosis to obtain economies of scale and increased manufacturing efficiencies for solar PV cells in order for solar electricity to compete economically with fossil fuel-fired electricity. Government policies necessary to construct a multi-gigaWatt PV factory and complementary policies to protect existing solar companies are outlined and the technical requirements for a symbiotic industrial system are explored to increase the manufacturing efficiency while improving the environmental impact of PV."

Government Programs Recognized: government-funded research, information/education campaigns, national renewable energy plans, regulations/standards, guaranteed markets, green pricing and financial incentives.

Government Requirements: To get the scale of PV manufacturing required, the massive scale up and technology required in a single plant would require an initial investment of ~$600 million. Most governments are financially secure and politically stable enough to be the medium for change. The investment can be seen in the same way that that government reserves are kept in banks to earn interest. Benefits come in the formation of jobs, economic growth, reduced GHGs, energy stability and technological growth. Governments can stimulate the market and protect domestic plants by implementing PVs on its buildings and other maintained properties.

Other interesting points: The photovoltaic market, Scale and photovoltaic manufacturing, Industrial Symbiosis

Solar Module Retail Price Environment

The Case for reducing PV prices. The price decline trend from the beginning of 2009 continues in the June survey result. While the total number of price declines was lower this month, their individual magnitude caused the largest single month reduction in the United States index since the survey started in 2001.

The tracking of the lowest price band in the survey is measured against the number of prices below $4.75 per watt.

As of June 2009, there are currently 370 solar module prices below $4.75 per watt (€3.42 per watt) or 26.5% of the total survey. This compares with 313 prices below $4.75 per watt in May. The lowest retail price for a multi-crystalline silicon solar module is $2.48 per watt (€1.79 per watt) from a US retailer. The lowest retail price for a monocrystalline silicon module is $2.80 per watt (€2.02 per watt), from a US retailer.

Note, however, that "not all models are equal." In other words, brand, technical attributes and certifications do matter.

The lowest thin film module price is at $1.76 per watt (€1.26 per watt) from an Asian-based retailer. As a general rule, it is typical to expect thin film modules to be at a price discount to crystalline silicon (for like module powers). This thin film price is represented by a 130 watt module, albeit deliveries of this particular model are not available until July.

World solar photovoltaic (PV) market installations reached a record high of 5.95 gigawatts (GW) in 2008, representing growth of 110% over the previous year.

David Owen,Top stories 2008: Fab and Facilities—Q-Cells leads the pack,2008

Q-Cells announced plans to build a thin-film manufacturing facility on a 60ha site in the Silicon Border business park located near Mexicali, Mexico. The $3.5 billion commitment also showed that Q-Cells had its eye on First Solar's top thin film position, as the size of the investment and site will allow Q-Cells to aggressively ramp in order to take advantage of the burgeoning US utility market.

Malaysia has been a strong contender in PV manufacturing since First Solar and, in May, SunPower agreed to get on board. Tom Werner, CEO of SunPower, announced plans to build a new c-Si facility in Malaysia that will see 1GW of capacity by 2010.

Masdar announced an ambitious Solar Cities project early in 2008. Applied Materials had secured a $2 billion order for its turnkey 'SunFab' line.

Mark Osborne,PV production: The dawn of the "gigawatt" fab, 2008

We discuss the opportunities for scaling PV manufacturing with Robert Gattereder,Managing Director of M+W Zander FE GmbH after a detailed study challenges the current mindset and forces manufacturers to consider scaling manufacturing to new heights.

"Manufacturing cost savings in the region of 15 percent were possible when production reached the gigawatt level"

M+W Zander believes that the waferbased gigawatt fab will need to be highly integrated and scalable. Due to capital costs and manufacturing ramp timescales, a gigawatt fab could be established in two major steps. The plant (see Figure 1, overleaf) would consist of approximately two 450MW modules with each module having a dedicated wafering, cell manufacturing and module assembly area.

According to M+W Zander, thin film fabs could benefit from an area ratio improvement of as much as 12 percent when scaled to the gigawatt production level, as shown in Table 2. Another revealing aspect of the M+W Zander study is the ability for thin film facilities to be even more cost-competitive at the gigawatt scale. With overall utility cost savings as highlighted earlier, a comparison between wafer-based and thin film manufacturing (see Table 3) shows that thin film utility demands are significantly less than those for wafers.

I-Micronews,Global Photovoltaic (PV) manufacturing capacity will reach 12.5GW in 2008,2008

Based on tracking 800 companies in the photovoltaic industry, Yole Developpement has a complete view on market statistics for worldwide PV production capacity.

Yole estimates the global capacity of thin films to be 2.5GW in 2008. This capacity is lower than the 10GW for wafer based technology, but the growth rate is much higher. Pushed by turnkey fab suppliers, the typical size of thin film projects jumped from 25MW in 2006 to 60-80MW in 2007 and to 500-1,000MW in 2008. For 2010, Gaetan Rull expects a minimum of 7GW of installed thin film production capacity.

Papers/Sources[edit | edit source]

2009[edit | edit source]

Robert Pollin and Heidi Garrett-Peltier,Building the Green Economy,Employment Effects of Green Energy Investments for Ontario, 2009[edit | edit source]

This report also makes it clear that most of these 'new' green-collar jobs are in fact familiar jobs, repurposed and expanded through investments in a low-carbon economy. The green economy will require construction, manufacturing and steel workers, as well as engineers, administrators, accountants and research scientists. The people employed in these jobs will help consumers cut their energy use and hence bills by improving energy efficiency. And they will create new industries and new economic opportunities for Ontarians to design, build and install the green energy technologies that this province, and the planet, need if we are to avoid dangerous levels of global warming.

The government of Ontario is poised to implement an ambitious Green Energy Act. This program has the potential to produce substantial benefits to the citizens of Ontario, both in terms of environmental protection and the expansion of employment opportunities. The focus of this study is on the potential employment benefits of a green investment agenda for Ontario.

J.K. Kaldellis, D. Zafirakis, E. Kondili, Optimum autonomous stand-alone photovoltaic system design on the basis of energy pay-back analysis, Energy, In Press, Corrected Proof, Available online 9 June 2009[edit | edit source]

Abstract: Stand-alone photovoltaic (PV) systems comprise one of the most promising electrification solutions for covering the demand of remote consumers. However, such systems are strongly questioned due to extreme life-cycle (LC) energy requirements. For similar installations to be considered as environmentally sustainable, their LC energy content must be compensated by the respective useful energy production, i.e. their energy pay-back period (EPBP) should be found less than their service period. In this context, an optimum sizing methodology is currently developed, based on the criterion of minimum embodied energy. Various energy autonomous stand-alone PV-lead-acid battery systems are examined and two different cases are investigated; a high solar potential area and a medium solar potential area. By considering that the PV-battery (PV-Bat) system's useful energy production is equal to the remote consumer's electricity consumption, optimum cadmium telluride (CdTe) based systems yield the minimum EPBP (15 years). If achieving to exploit the net PV energy production however, the EPBP is found less than 20 years for all PV types. Finally, the most interesting finding concerns the fact that in all cases examined the contribution of the battery component exceeds 27% of the system LC energy requirements, reflecting the difference between grid-connected and stand-alone configurations.

A. Focacci, Residential plants investment appraisal subsequent to the new supporting photovoltaic economic mechanism in Italy, Renewable and Sustainable Energy Reviews, In Press, Corrected Proof, Available online 7 May 2009[edit | edit source]

Jennifer Cleary and Allison Kopicki, Preparing the Workforce for a "Green Jobs" Economy, John J. Heldrich Center for Workforce Development, pp 1-12, February 2009[edit | edit source]

As the United States embarks on its journey toward a clean energy economy, the buzz about the promise of "green jobs" has gained momentum among politicians, media, community organizers, educators, and workforce development stakeholders. This brief identifies the types of jobs and skills that will be in demand in this green future and the factors that are driving the new energy economy and the growth of its workforce. Finally, this brief considers strategies for building competitive, flexible workforce systems that can respond to emerging employer needs and highlights best practices occurring around the nation.

Mark Osborne,Evergreen Solar shifts manufacturing future to China, targets US$1/W in 2012, May 2009[edit | edit source]

Tyler Hamilton,1,200 'green jobs' in works for Kingston, The Star, March 2009[edit | edit source]

First Solar Inc.,First Solar Passes $1 Per Watt Industry Milestone, 2009[edit | edit source]

Mark Osborne,SolarWorld targets 1GW cell production in Freiberg, May 2009[edit | edit source]

"SolarWorld AG has celebrated the topping-out of its new crystalline solar cell manufacturing plant in Freiberg, Germany. The €350 million investment will enable SolarWorld to add approximately 500MW per annum of solar cell capacity by the end of 2010, resulting in 1GW of total capacity at its multiple facilities in Freiberg."

Government investment in AIBP expected to lead to creation of 40 jobs,The Nationalist, 30th May 2009[edit | edit source]

2008[edit | edit source]

Work Isn't Working for Ontario Families, The Role of Good Jobs in Ontario's Poverty Reduction Strategy,Campaign 2000, Toronto & York Region Labour Council, Canadian Labour Congress (Ontario Region),May, 2008[edit | edit source]

Campaign 2000, the Toronto & York Region Labour Council and the Canadian Labour Congress (Ontario Region) see roles for government, labour and the private sector in increasing the availability of good jobs in Ontario to re-build a broad middle-income sector and enable more Ontario parents to lift their families out of poverty. Restoring the centre to manufacturing workers is one challenge; gaining the centre for marginalized workers in bad jobs is another. Within the broad range of its powers, the provincial government can do much to lead labour and the private sector into a change process to the benefit of low-income children whose parents are struggling to build a secure life. Regulation, unionization, stimulation of manufacturing for a green planet and public investment can all support parents toward a more secure standard of living for their families and recreate a broad, stable social base for Ontario. Strategic approaches to strengthening the labour market in Ontario for low-income parents include:

- Turning bad jobs into good jobs through regulation and unionization

- Investing in essential public resources and maximizing the public benefit of public procurement

- Stimulating manufacturing for the global green economy.

Government of Canada investment to expand Manitoba biodiesel industry,Western Economic Diversification Canada, 2008][edit | edit source]

Robert Pollin, November 7, 2008, Green Investments and Jobs: A Response to the Heritage Foundation,Center for American Progress[edit | edit source]

Industry Canada, Performance Report — For the Period Ending March 31, 2008[edit | edit source]

Brad Collins, US$4.5 trillion: Opportunity knocks, Renewable Energy Focus, Volume 9, Issue 2, March-April 2008,pp56-58, 60, (http://www.sciencedirect.com/science/article/B8JJF-4T5BWPN-1C/2/c0efbb91db87b16ce4e110ddd7960768)[edit | edit source]

Johannes VAN BIESEBROECK Bidding for Investment Projects:Smart Public Policy or Corporate Welfare?,pp 1-28, 2008[edit | edit source]

The Cost of Inaction: Failing to Address Climate Change Stifles Green Job Creation , 2008[edit | edit source]

the opportunity still exists to invest in green technologies that would generate manufacturing, construction and installation jobs and to protect against fossil fuel supply disruptions and price fluctuations. American leadership on climate change could play a vital role in stimulating green job creation while simultaneously reducing greenhouse gas emissions.

Photovoltaic (PV) panels generate 15.2 manufacturing jobs per megawatt installed and 7.1 construction and installation jobs per megawatt-more jobs in both categories than any other renewable energy source. Producing electricity from PV provides jobs to roofers, electricians, sheet metal workers, and other skilled laborers. Approximately 80 percent of the jobs in PV come from manufacturing and assembly. The remaining jobs come mostly from installing the PV panels. Many component parts must be manufactured to build solar PV systems, including metals, glass, raw silicon, batteries, wiring, and roof mounting structures to hold the solar panels in place. The solar panels must also be assembled prior to installation. Workers are needed to assemble the solar cells, to prepare them for installation, and connect them to the electrical grid. Finally, maintenance workers are needed to provide routine maintenance and repairs to the panels

Ted Kesik and Anne Miller,[TORONTO GREEN DEVELOPMENT STANDARD COS T - B ENEFIT STUDY], pp 1-246, 2008[edit | edit source]

The Toronto Green Development Standard is among a number of instruments being fashioned by the City of Toronto to address negative impacts associated with urban growth, but it is not intended to address all issues related to sustainable development. It has instead been based on a bio-regional approach to green development that recognizes the unique ecosystem that Toronto shares with the numerous communities that border the Great Lakes.

Masdar breaks ground on photovoltaic factory in Germany, 2008[edit | edit source]

The Masdar Initiative is Abu Dhabi's multi-faceted, multi-billion dollar investment in the development and commercialization of innovative technologies in renewable, alternative and sustainable energies as well as sustainable design. Masdar is driven by the Abu Dhabi Future Energy Company (ADFEC), a wholly owned company of the government of Abu Dhabi through the Mubadala Development Company. In January 2008, Abu Dhabi announced it will invest $15 bn in Masdar, the largest single government investment of its kind. For more information about the Masdar Initiative, visit www.masdaruae.com.

B.Shone, Feed-in Tariffs in Australia,Alternative Technology Association, 2008[edit | edit source]

2000 - 2007[edit | edit source]

Western Economic Diversification Canada,Canada's New Government Assists Rural Diversification with Bio-Products Investment, 2007[edit | edit source]

Jenkins, Glenn and Chun-Yan Kuo, The Economic Opportunity Cost of Capital for Canada-An Empirical Update, QED Working Paper Number 1133, Department of Economics, Queen's University, Kingston, Canada, 2007.[edit | edit source]

COMMUNITY JOBS IN THE GREEN ECONOMY, 2007[edit | edit source]

In this report, we present an overview of key industries in the green economy, as well as discussions about the necessary workforce development infrastructure needed to train workers to take advantage of these opportunities. We also provide some case studies of Americans who are already employed in these jobs. Finally, we present strategies that cities can use to take advantage of this new economic development engine. Our goal is to provide a roadmap for community organizers, economic development practitioners, labor representatives, and city managers who wish to learn about and create high quality, green jobs in their communities

Ontario Ministry of Energy. Community+Small Project Support:Standard Offer-Expanding Renewable Energy Opportunities.Queen's Printer for Ontario; 2007.[edit | edit source]

Canada Energy Future Reference Case and Scenarios to 2030,An Energy Market Assessment November 2007, pp 1 -414[edit | edit source]

http://www.neb.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/nrgyftr/2007/nrgyftr2007chptr4-eng.html#s4_9

Trina making profits from Selling solar PV[edit | edit source]

Winfried Hoffmann, PV solar electricity industry: Market growth and perspective, Solar Energy Materials and Solar Cells, Volume 90, Issues 18-19, 14th International Photovoltaic Science and Engineering Conference, 23 November 2006, Pages 3285-3311,(http://www.sciencedirect.com/science/article/B6V51-4KST3HK-1/2/c1d0d4600619ef3f7004102d1a313de5)[edit | edit source]

Randall Parker,Rapid Growth In Photovoltaics Demand Driven By Germany,Future Pundit 2006[edit | edit source]

Gregory F. Nemet, Beyond the learning curve: factors influencing cost reductions in photovoltaics, Energy Policy, Volume 34, Issue 17, November 2006, Pages 3218-3232[edit | edit source]

Abstract: The extent and timing of cost-reducing improvements in low-carbon energy systems are important sources of uncertainty in future levels of greenhouse-gas emissions. Models that assess the costs of climate change mitigation policy, and energy policy in general, rely heavily on learning curves to include technology dynamics. Historically, no energy technology has changed more dramatically than photovoltaics (PV), the cost of which has declined by a factor of nearly 100 since the 1950s. Which changes were most important in accounting for the cost reductions that have occurred over the past three decades? Are these results consistent with the notion that learning from experience drove technical change? In this paper, empirical data are assembled to populate a simple model identifying the most important factors affecting the cost of PV. The results indicate that learning from experience, the theoretical mechanism used to explain learning curves, only weakly explains change in the most important factors--plant size, module efficiency, and the cost of silicon. Ways in which the consideration of a broader set of influences, such as technical barriers, industry structure, and characteristics of demand, might be used to inform energy technology policy are discussed.

Ken Gordon & Fraser Summerfield, Wind Energy in Canada, Government Role, 2005[edit | edit source]

Roger H. Bezdek, Robert M. Wendling,JOBS CREATION IN THE ENVIRONMENTAL INDUSTRY IN CALIFORNIA AND THE UNITED STATES, 2005, pp 1-99[edit | edit source]

A. Taylor, M. Bramley, M. Winfield, Government Spending on Canada's Oil and Gas Industry, Undermining Canada's Kyoto Commitment, January 31, 2005, Commissioned by Climate Action Network Canada, The Pembina Institute, pp 1-57[edit | edit source]

Governments in Canada, as well as elsewhere, subsidize a number of socially beneficial services. These include, for example, health care, education and energy services. To the extent that subsidies provided to the energy sector are for oil and gas developments, however, they are contributing to increased environmental impacts and hindering developments of environmentally friendly alternative energy options. The purpose of this study is to investigate government expenditure on the oil and gas sector in Canada. To that end, we identify and document the various forms of public support provided to this industry by the federal government. We focus on federal government support provided through grants (direct expenditure), the tax system (tax expenditure) and government departments (program expenditure) for conventional oil and gas as well as for oil sands between 1996 and 2002. We also discuss provincial support for oil sands.

In the late 1980s and early 1990s, the federal government supported energy megaprojects. This included, for example, the Hibernia Development Project and heavy oil upgraders.2 Since 1995, federal spending on non-renewable energy resources has been significantly reduced. While it is true, then, that current subsidies are lower than in the past, they are still substantial. Government expenditure on the oil and gas sector including tax, program and direct expenditure totalled $1,085 million (2000$) in 1996 and $1,446 million (2000$) in 2002. The increase in expenditure over this time period was 33%. Total expenditure from 1996 to 2002, inclusive, was equal to $8,324 million (2000$). The vast majority of the expenditure is associated with tax initiatives and in particular the Canadian Development Expense, the Canadian Exploration Expense, the Resource Allowance and the Accelerated Capital Cost Allowance for oil sands. Other research has demonstrated relatively low taxation levels for the oil and gas sector, high tax concessions for oil sands4 and relatively high profits of oil and gas companies. In addition, previous research comparing the amount of revenue collected from oil and gas developments in Canada with that collected in Alaska and Norway revealed that, relative to these international benchmarks, companies extracting Canada's oil and gas, most of which belongs to the public, are receiving an implicit subsidy in the form of excessive profits that governments are failing to capture through taxes, royalties and other revenue generating policy options.

Joe Ruggeri & Melanie Doucet, GOVERNMENT SPENDING ON HEALTH CARE AS PUBLIC INVESTMENT, 2005[edit | edit source]

Most of the investment by the department of Health (86 percent) is in the form of investment in human capital. The results also show that thirty-eight percent of personal income tax expenditures and forty-four percent of goods and services tax expenditures can be treated as investment in human capital.

Canada's First Vertically Integrated Solar Photovoltaic Manufacturing Facility Opens in Cambridge Ontario: New Spheral Solar™ Technology,NRCAN, 2004[edit | edit source]

ATS Automation Tooling Systems Inc. opened Canada's first full-scale 20-megawatt solar cell manufacturing line and unveiled its revolutionary new photovoltaic technology that will be produced from its highly automated Spheral Solar™ Power (SSP) plant - a 193,000 square feet facility located in south-western Ontario city of Cambridge.

Also in 2003, the Government of Canada, through Industry Canada's Technology Partnership Program, invested $25.5 million and an additional $4 million from TEAM to leverage a $67 million private sector spending to commercialise the Spheral Solar™ technology. The SSP facility currently employs 150 people and is planning to augment this workforce to 220 by the end of this calendar year.

Keshner MS, Arya R. Study of potential cost reductions resulting from super-large-scale manufacturing of PV modules. National Renewable Energy Laboratory final subcontract report, 2004,NREL/SR-520-36846.[edit | edit source]

Genome CanadaInterim Evaluation of Genome Canada,March 31, 2004[edit | edit source]

Sean P. McAlinden, Ph.D.,Kim Hill MPP,Bernard Swiecki,Economic Contribution of the Automotive Industry to the U.S.Economy – An Update,Economics and Business Group, Center for Automotive Research, Fall 2003[edit | edit source]

In summary, the employment contribution currently associated with total automotive industry activity in the United States is estimated to be about 3.5 million jobs in the private sector attributable to the industry directly and its suppliers, and 6.6 million when all spin-off effects are included. The compensation contribution is estimated to be about $152 billion attributable to the industry directly and its suppliers, and $243 billion when all spin-off effects are included.

Weiss I, Sprau P, Helm P. The German PV solar power financing schemes reflected on the German PV market. In: Proceedings of the third world conference on photovolt energy conversion, vol. 3; 2003.p. 2592–5.[edit | edit source]

Abstract: Since the intmduction of the 100 000 Roofs Solar Power Programme and the new Renewable Energy Law (E L) the German PV Market is extending remarkablyThe German KfW-financing in the framework of the 100 000 PV roofs programme increased from 9 MW in 1999 to almost 80 MW in 2002. The perspectives for 2003 are in the order of magnitude of 100 MW and 2003 will become a huther and probably final booming year for PV roof installations since the Ktw-fmancing schemes level-off by the end of 2003.

However, the production of PV modules in Germany comprises only one third of the installed PV power.Two thirds of the PV modules are imported. This shows that even a programme offering funding which i s close to rate-based mentive is not necesrady followed by the PV industry to install new production lines and/or to extend existing production facilities. While Japan was able to mcreasc the production capacity smultaneously with the programme, other counmes, such as Germany,experience a delay of the extension of production capacities for PV modules with respect to the demand.

This Paper outlines the funding programs in several countries.The main characteristics of a PV market, which led to the tremendously extending market volume, are as follows:

- a positive public opinion of citizens concerning renewable energies resulting in a high demand - high grants and high commitment through state and federal governments

- involvement of utilities in renewable energy sources

- high number of market participants from manufacturers to system installers and distributors

- long-term perspectives for investors

Brad Heavner & Susannah Churchill, Renewables Work, Job Growth from Renewable Energy, Development in California, CALPIRG Charitable Trust, June 2002.[edit | edit source]

Each new solar, wind, biomass, or fuel cellrelated job created is, in effect, a vote for energy security, price stability, and generally a vote to buy American. Renewable energy is a plentiful resource in the U.S., and therefore each new job in this field is another job, and another dollar of gross national product, that we choose to reinvest in the American economy as opposed to providing as a subsidy to OPEC and other nations.

Thus, each new solar system, windmill, or fuel cell sold represents new economic activity and growth. This has two effects: 1) investments in renewables are truly investments in job creation; and 2) with relatively few of these systems in the field, the cost declines through learning. This learning curve will result in dramatic decreases in per unit costs as sales ramp up. A double victory.

Table 1. EPRI Employment Rates with Annual Reduction (jobs/MW) The study concluded that wind and PV create 40% more jobs per dollar of investment than coal. This study also calculated job creation in the different work activities involved. For solar, 30% of the jobs would be for module assembly, 42% for other manufacturing activities, 21% for distribution and contracting, and 7% for servicing.

Note on Units

Harberger, Arnold C. and Glenn P. Jenkins, Manual on Cost Benefit Analysis for Investment Decisions, Queen's University, Kingston, Canada, 2002[edit | edit source]

David Johnson and Roger Wilkins,The Net Benefit to Government of Higher Education: A "Balance Sheet" Approach,Melbourne Institute Working Paper No. 5/02, pp 1-40, 2002[edit | edit source]

New Analysis Shows Economic Benefits From Meeting Kyoto Target, 2002[edit | edit source]

Energy-efficiency innovations, cleaner fuels and other measures to reduce greenhouse gas emissions will generate jobs and economic growth for Canada, according to a study by the Boston-based Tellus Institute released in Ottawa today.

"The benefit of implementing these policies to reduce annual greenhouse gas emissions would exceed the costs. Our study forecasts the net addition of 52,000 Canadian jobs by 2012, and a $2 billion addition to the GDP, over and above the growth forecast in 'business as usual' Canadian government projections."

Peter Foreman,The transfer of accounting technology: a study of the Commonwealth of Australia government factories, 1910-1916, Accounting History, Vol. 6, No. 1, 31-59 (2001)[edit | edit source]

Abstract: The establishment of government factories by the Commonwealth of Australia, 1910-1916, required, inter alia, the development of an accounting system to suit the commercial activities carried on by government. All these factories were suppliers to the defence forces. Their primary aim was not profit generation, but the maintenance of facilities that could be expanded rapidly in time of need. Some of these factories were in direct competition with private industry and it was important that their costs and prices compared favourably with the nongovernment sector. The Australian government introduced a system of accounting that was developed by John Jensen, a Defence Department public servant. Jensen espoused scientific management techniques observed during a visit to the USA and Canada in 1910. This study explores the origins of, and influences on, the accounting system as established by Jensen. It does so through the use of the technology transfer construct advanced by Jeremy (1991). The conclusion reached is that Taylorist precepts were significantly modified to meet the particular control requirements and the environmental factors faced by Australian governments.

Jean-Baptiste Lesourd,Solar photovoltaic systems: the economics of a renewable energy resource, Environmental Modelling & Software, Volume 16, Issue 2, March 2001, Pages 147-156[edit | edit source]

Abstract: This paper analyses some emerging aspects of the economics of grid-connected photovoltaic systems. While the 1997 cost of photovoltaic systems is estimated as 5.5 US$/Wp, a 1997 cost estimate for photovoltaic grid-connected electricity is (deflated terms) 0.25 or (nominal terms) 0.29 US$/kWh, for US sunbelt conditions, prevailing US capital market conditions, and an economic lifetime of 20 years. This compares to about 0.10 US$/kWh for conventional electricity production. Other estimates for are, respectively, in deflated and nominal terms and in US$/kWh, 0.30 and 0.35 (average US conditions), 0.29 and 0.33 (average Western European conditions), 0.23 and 0.27 (sunbelt European conditions), and 0.33 and 0.34 (average Japanese conditions). Assuming a longer system lifetime (30 years) lowers these costs by 15-20%. Dividing costs by 2, a reasonable future possibility, would bring them close to competitiveness. Further cost decreases, although possible, are still uncertain. The structure and future evolution of the world photovoltaic industry are also discussed.

d'Estaintot T. European commission-supported R&D activities in the field of photovoltaics. In: Proceedings of 28th IEEE Photovoltaic Specialists Conference, 2000. p. 1734–5[edit | edit source]

Abstract Since 1980, the European Commission has funded medium to long term research photovoltaics projects for over 150 Million Euros in addition to short term research, demonstration and infrastructure projects as well as promotional programmes. For example, JOULE, THERMIE, ALTENER are well-known EC programmes within the PV community. Today, the Fourth Framework Programme (FP4) which has launched those R&D activities during the period 1994-1998 sees its PV projects coming to an end, while new ones are starting under the Fifth Framework Programme (FP5: 1999-2002). Photovoltaics has a strong position among the new and renewable energy sources that have been selected as priority themes within the Energy, Environment and Sustainable Development (EESD) main EC programme of FP5. International collaboration of European organizations outside EU-15 is being encouraged at research level to maximize mutual benefits and avoid unnecessary overlaps or duplication. In particular, EU/US cooperation in the field of PV is part of an Implementing Arrangement that follows the 1997 Science and Technology Agreement signed between the two regions

1900s[edit | edit source]

Irma Adelman,THE ROLE OF GOVERNMENT IN ECONOMIC DEVELOPMENT,California Agricultural Experiment Station, Giannini Foundation of Agricultural Economics Working Paper No. 890, 1999[edit | edit source]

Michael T. Eckhart, Financing Solar Energy in the U.S., 1999, Scoping Paper[edit | edit source]

This document is a "scoping paper" on the subject of financing the end-use applications (the "markets") for solar energy in the U.S.2 The purpose of a scoping paper, somewhat like "terms of reference," is to describe the subject, characterize the current situation, and identify and assess the key issues. The next step, based on the scoping paper, will be a published policy paper entitled "Financing Solar Energy in the U.S."

Western Canada's biodiesel industry will receive a boost thanks to a $330,000 investment from Western Economic Diversification Canada to develop and market BioFleet, a new program to increase awareness of the biodiesel industry and showcase its environmental benefits.

Over the long term, a $1 million increase in green investment spending that is offset by a $1 million reduction in spending within the oil industry will still produce a net increase of 12.5 jobs in U.S.

Glenn P. Jenkins and Henry B.F. Lim,Evaluation of Investments for the Expansion of an Electricity Distribution System,Development Discussion Papers No.670, December 1998, pp1-64[edit | edit source]

Townley, Peter G. C., Principles of Cost-Benefit Analysis in a Canadian Context, Scarborough: Prentice Hall Canada Inc., 1998[edit | edit source]

Paul D. Maycock,Cost reduction in PV manufacturing impact on grid-connected and building-integrated markets, Solar Energy Materials and Solar Cells, Volume 47, Issues 1-4, October 1997, Pages 37-45[edit | edit source]

Abstract: In the past three years there have been several key events or changes that can lead to fully economic, massive deployment to the grid-connected and central PV markets. The factors discussed in this report include: (1) Significant cost reduction in single crystal and polycrystal silicon so that modules profitably priced at $3.10-$3.30 per peak watt and installed grid-connected systems with installed cost of $5.50 per watt are being offered. (2) Several new thin film plants - amorphous silicon, cadmium telluride, and copper indium diselenide are being built for 1996, 1997 production with greatly reduced costs. (3) Government subsidized volume orders for PV in grid-connected houses (Japan, Germany, Switzerland, Italy, and the United States) provide volume (2000 + units per year) that lead to reduced costs. (4) Environmental benefits for PV are being applied in Europe and Japan permitting 'early adopters' to enter the market. (5) Government and commercial acceptance of PV building integrated products, especially in Europe, are expanding PV markets. The combination of these forces lead to the prediction that an 'accelerated' market mode could start in the year 2000.

Ellis J, Peake S. Renewable energy promotion in IEA countries.Renewable Energy 1996;9(1-4):1175–8.[edit | edit source]

David F. Larcker, Lawrence Revsine, The Oil and Gas Accounting Controversy: An Analysis of Economic Consequences, The Accounting Review, Vol. 58, No. 4 (Oct., 1983), pp. 706-732, American Accounting Association[edit | edit source]

Carliss Baldwin, Donald Lessard, Scott Mason, Budgetary Time Bombs: Controlling Government Loan Guarantees, Canadian Public Policy / Analyse de Politiques, Vol. 9, No. 3 (Sep., 1983), pp. 338-346[edit | edit source]

An important deficiency of federal budgets is that they omit the expected costs of policies that guarantee private borrowings. Although guarantees do not involve immediate cash spending, they are costly because they commit the government to future (contingent) cash outlays. Thus the expected cost of guarantees should enter the 'envelope' of planned spending so that resources can be consistently allocated among the government's goals or among departments. How could this be done? The authors explain the calculation of a guarantee's cash grant equivalent, and argue that this measure should be listed as a cost for budgeting, planning and control.

Governments use financial incentives to induce private firms to undertake investments that are deemed to be socially desirable, but which are not privately feasible. Such investments include projects which create jobs in thin labour markets as well as projects which preserve jobs by assisting distressed corporations such as Massey-Ferguson or Chrysler. Types of incentives include cash grants, guarantees, concessionary loans, direct investments, and tax preferences such as tax holidays, tax credits, or special depreciation allowances.

paper indicates Framework for computing cash grant-equivalents

Jenkins, Glenn P., "The Public-Sector Discount Rate for Canada: Some Further Observations." In: Canadian Public Policy, Summer 1981.[edit | edit source]

Glenn P. Jenkins, Inflation and Cost-Benefit Analysis,QED, pp1-23, 1978[edit | edit source]

There are six ways in which inflation can affect the financial analysis of a project:

- Additional loan of equity needed throughout the life of the project must be done at the price level of the given year

- Inflation reduces the value of the tax deduction through depreciation (capital cost allowance), since the depreciated value of the asset decreases with inflation

- Tax implications for companies that hold inventories of inputs and outputs. Using the historical value of the inventory, the taxable income would be overestimated.

- Impact on nominal interest rates: i = r + gPe (The existence of inflation forces the borrower to repay his loans faster than he usually would)

- Nominal interest and taxable income: in most countries, interest payments (expense) are deductible from income for income tax calculation.

- Effect on real value of cash balances. (inflation tax on cash balances)

i = r + R + (1+ r + R)gPe

The steps required for carrying out the analysis of correctly accounting for inflation are outlined.

Canada, Treasury Board of Canada Secretariat, Benefit-Cost Analysis Guide, Ministry of Supply and Services, 1976[edit | edit source]

David F. Bradford,Constraints on Government Investment Opportunities and the Choice of Discount Rate, © 1975 American Economic Association.[edit | edit source]

Jenkins, Glenn P., Measurement of Rates of Return and Taxation from Private Capital in Canada. In: Benefit-Costs Analysis, W.A. Niskanen et al., editors, Aldine, 1972[edit | edit source]

Agnar, Sandmo and Jacques Dreze, "Discount Rates for Public Investment in Closed and Open Economics." In: Economica, November 1971[edit | edit source]

Other[edit | edit source]

The Report of the National Advisory Panel on Sustainable Energy Science and Technology, Funding of Canadian Energy S&T[edit | edit source]

The Need for Canada to increase its funding in R&D for sustainable energy resources, compared to other countries.

Crina Viju, William A. Kerr and James Nolan, Subsidization of the Biofuel Industry:Security vs. Clean Air?,pp 1-41[edit | edit source]

As the current price of biofuel is considerably greater than the price of fossil fuel alternatives, the governments around the world are heavily subsidizing the development of this industry. This paper focuses on the growth of biofuel industry in Canada and US. We develop a theoretical model to examine whether or not the same governmental policy (subsidization) yields different results i.e. a different level of optimal subsidies under different current objectives. We consider that subsidizing the development of the biofuel industry in the present is equivalent to buying an option on its use for future goals – energy security or reduced GHG emissions- so our research uses option value theory to assess these alternatives. The theoretical model yields an optimal subsidy option function for each of the two countries. Furthermore, under the scenario of obtaining different optimal levels of subsidies in the two countries, trade disputes can arise. A numerical simulation method is proposed to quantify the optimal level of subsidy option for each country.

'Lolade Ososami, A closer look at Taxation as a tool for Revenue Generation and the Promotion of Investment in Nigeria, pp 1-3[edit | edit source]

Average hourly wages of employees by selected characteristics and profession, unadjusted data, by province (monthly)[edit | edit source]

Canada Average Salaries and Expenditures[edit | edit source]

Ontario's Engineers Salaries[edit | edit source]

Salart Survey for Engineers in Canada[edit | edit source]

Salaries and Wages in Canada | Canadian Salary Guide[edit | edit source]

MISI Papers, Jobs, Investment in Energy Sector][edit | edit source]

Thin Film Today, updates in Solar Industry[edit | edit source]

SolarBuzz, Solar PV Funding Programs[edit | edit source]

"A variety of funding mechanisms have been used to stimulate growth in the solar photovoltaic (PV) market, extend electricity generation in remote rural areas and support research, development and technology demonstration....Another factor behind market stimulation is to capture the jobs that can be created by the development of such a major new industry, whether in manufacturing or marketing of PV products and services. Funding has therefore sought to break the "chicken and egg" situation of an industry with an emerging technology that needs a big enough market to generate the commercial returns necessary to provide the investment that will make it cost competitive in the long term."

SolarBuzz,Solar PV Industry Cost and Price Trends[edit | edit source]

Resources[edit | edit source]

Citation List[edit | edit source]

- ↑ Ontario Medical Association, ICAP 2005 Report - Illness Costs of Air Pollution, 2005-2026 Health and Economic Damage Estimates, June 2005, http://web.archive.org/web/20070414131054/http://www.oma.org:80/Health/smog/report/ICAP2005_Report.pdf

- ↑ Invest in Ontario, Government Programs, http://web.archive.org/web/20100724043157/http://www.investinontario.com:80/resources/government_programs_progdetails.asp?pID=266, Last Reviewed April 2008

- ↑ EPIA and Green Peace, Solar Generation - V - 2008, http://www.epia.org/fileadmin/EPIA_docs/documents/EPIA_SG_V_ENGLISH_FULL_Sept2008.pdf

- ↑ Arnulf Jäger-Waldau, PV Report 2008, European Commission, DG Joint Research Centre,Institute for Energy, Renewable Energies Unit,September 2008, http://web.archive.org/web/20150223221100/http://re.jrc.ec.europa.eu/refsys/pdf/PV%20Report%202008.pdf